Have Home Values Hit Bottom?

Whether you’re already a homeowner or you’re looking to become one, the recent headlines about home prices may leave you with more questions than answers. News stories are talking about home prices falling, and that’s raising concerns about a repeat of what happened to prices in the crash in 2008. One of the questions that’s on many minds, based on those headlines, is: how much will home prices decline? But what you may not realize is expert forecasters aren’t calling for a free fall in prices. In fact, if you look at the latest data, there’s a case to be made that the biggest portion of month-over-month price depreciation nationally may already behind us – and even those numbers weren’t significant declines on the national level. Instead of how far will they drop, the question becomes: have home values hit bottom? Let’s take a look at the latest data from several reputable industry sources (see chart below): The chart above provides a look at the most recent reports from Case-Shiller, the Federal Housing Finance Agency (FHFA), Black Knight, and CoreLogic. It shows how, on a national scale, home values have changed month-over-month since January 2022. November and December numbers have yet to come out. Let’s focus in on what the red numbers tell us. The red numbers are the change in home values over the last four months that have been published. And if we isolate the last four months, what the data shows is, in each case, home price depreciation peaked in August. While that doesn’t guarantee home price depreciation has hit bottom, it confirms prices aren’t in a free fall, and it may be an early signal that the worst is already behind us. As the numbers for November and December are released, data will be able to further validate this national trend. Bottom Line Home prices month-over-month have depreciated for the past four months on record, but there’s a strong case to be made that the worst may be behind us. If you have questions about what’s happening with home prices in your local market, reach out to a trusted real estate professional.

5 Must Try Restaurants in SLC

5 Must Try Restaurants in SLC Salt Lake City is a vibrant, beautiful city filled to the brim with history, culture, natural beauty, and a noteworthy emerging food scene. These are five of our must-try spots in Salt Lake City, from sushi to pizza to sandwiches to pasta. Want more SLC recommendations? Don’t miss our full guide to the best restaurants in Salt Lake City. 5- Feldman's Deli If you’re looking for the most satisfying sandwich in Salt Lake City, head straight to Feldman’s in Sugar House. Feldman’s is the only Jewish deli within hundreds of miles and honors traditional Jewish cuisine in every dish. The thing to order here is the Sloppy Joe, and it’s nothing like the Sloppy Joes your mom used to make. Loaded with Corned beef, pastrami, thousand island and coleslaw on Jewish rye, this enormous sandwich is the most popular item on the menu. If you’re looking for something a little less “sloppy,” try the Trisha. Each sandwich comes with a side, so go for the hand-cut fries. 4- Takashi Any SLC native knows that Takashi serves the best sushi in Utah. With fish always flown in daily, everything is fresh, and no matter what you’re ordering, you can plan on it being absolutely incredible. The nigiri sampler is a must-try, along with the deconstructed azekura, the crunchy ebi, sunshine, and summit sushi rolls. If you still have room, don’t leave without trying the house-made panna cotta, which is an unexpected and delicious way to end your meal. Takashi is constantly packed, so be prepared for a wait. Show up right when at opening for lunch or dinner hours to avoid hours-long waits, or go with a few friends if you can secure a group reservation beforehand. 3- Settebello Pizzeria Napoletana Settebello is a true gem in the Salt Lake Valley. The ingredients and methodology used are identical to what you’ll find in Napoli, so you know this place serves up the most delicious and authentic Neapolitan pizza in all of Utah.The pizzas cook in under 90 seconds in a 900 degree oven and come out with the most delicate and perfectly charred crust. If you’re new to Settebello, order the Margherita, the #1 selling pizza, made with crushed tomatoes, fresh mozzarella, and basil. If you’re looking for something a little different, try the Diavola, made with red bell peppers, salami, garlic, fresh mozzarella, and basil, or the Settebello, complete with pine nuts, mushrooms, pancetta, and artichoke. Make sure to save room for some homemade gelato next door (the stracciatella and mango are the perfect end to an amazing meal!). 2- HSL With immaculate menu curation, local ingredients, and a chic vibe, HSL (Handle Salt Lake) is one of the best New American restaurants in the valley. Chefs Briar Handly and Igor Legname prioritize seasonal, local, and organic ingredients to create delicious and upscale dishes. The menu is divided into three sections, cold, hot, and hearty, for a unique take on fine dining. Don’t miss the buttermilk biscuit, general tso’s cauliflower, or the fried chicken when available. If you’re in the Park City area, check out sister restaurant, Handle, which serves similarly amazing food on historic Main Street. 1- Valter's Osteria Created and lovingly crafted by the late Valter Nassi, Valter’s is more than an Italian fine-dining establishment, it’s an experience any true food enthusiast must partake of. The menu is the perfect balance of classic dishes and new seasonal picks. Favorite mainstays include the chopped agnelli salad, tutta pasta di valter (pasta sampler), lasagna made with Valter’s mother’s meat sauce, butternut squash and sage ravioli, and chicken piccata. Don’t leave without trying the lemon gelato drizzled with local honey and salt. You’ll definitely want to make reservations at this spot as it fills up quickly. Valter’s is perfect for a special occasion or for when you want an incredible dining experience. You want more delish recommendations like this? Head on over to FemaleFoodie.com now!

Today's Housing Market is NOT like 2008. Here's Why.

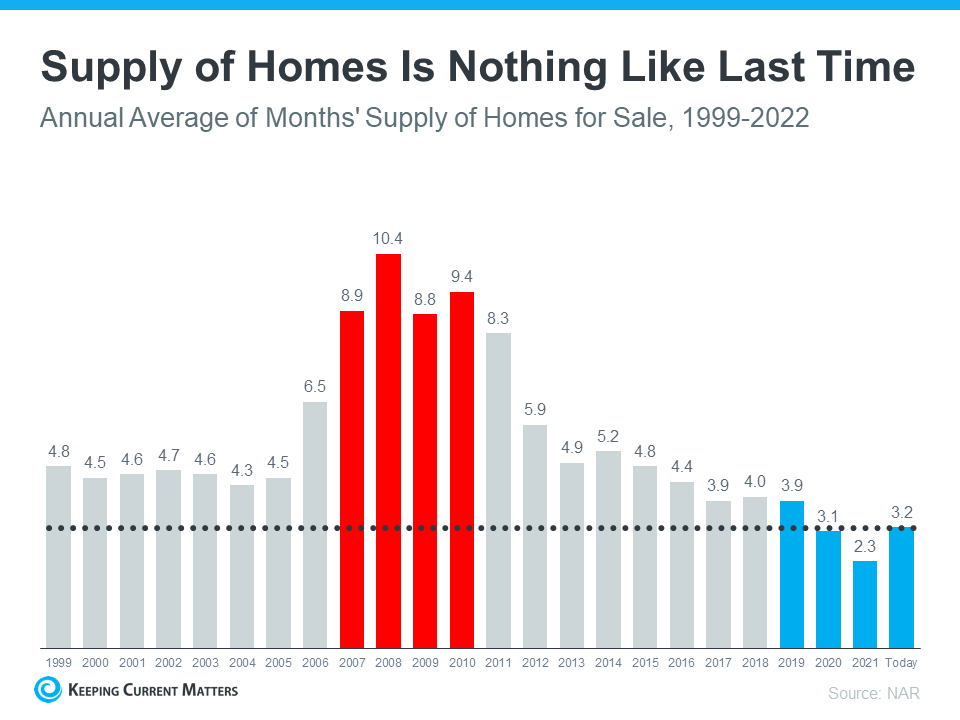

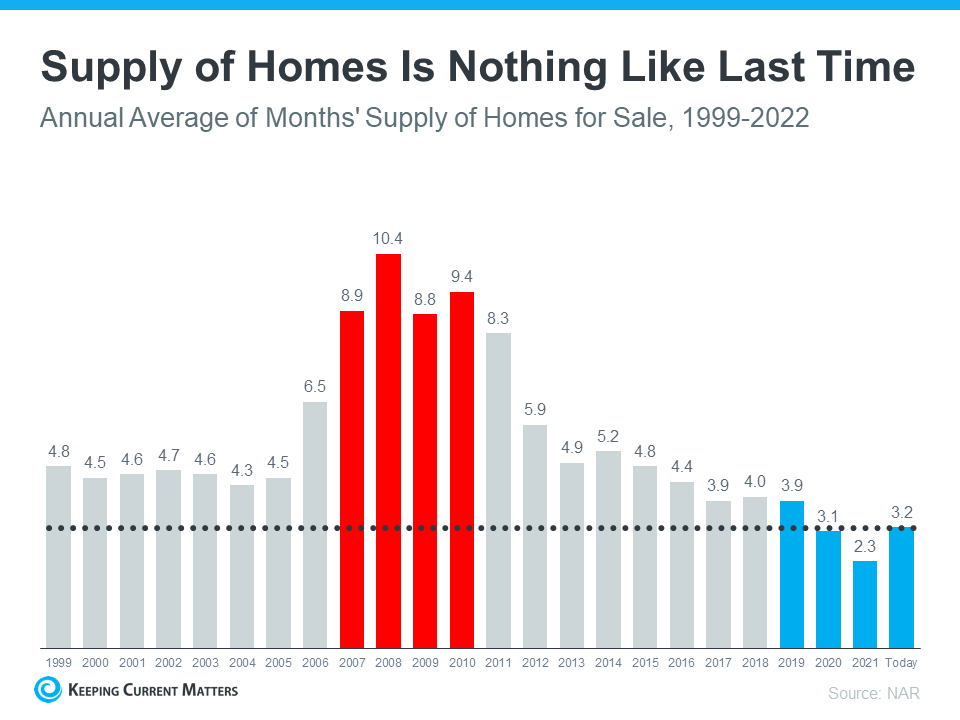

With all the headlines and talk in the media about the shift in the housing market, you might be thinking this is a housing bubble. It’s only natural for those thoughts to creep in that make you think it could be a repeat of what took place in 2008. But the good news is, there’s concrete data to show why this is nothing like the last time. There’s Still a Shortage of Homes on the Market Today, Not a Surplus For historical context, there were too many homes for sale during the housing crisis (many of which were short sales and foreclosures), and that caused prices to fall dramatically. Supply has increased since the start of this year, but there’s still a shortage of inventory available overall, primarily due to almost 15 years of underbuilding homes. The graph below uses data from the National Association of Realtors (NAR) to show how the months’ supply of homes available now compares to the crash. Today, unsold inventory sits at just a 3.2-months’ supply at the current sales pace, which is significantly lower than the last time. There just isn’t enough inventory on the market for home prices to come crashing down like they did last time, even though some overheated markets may experience slight declines. Mortgage Standards Were Much More Relaxed Back Then During the lead-up to the housing crisis, it was much easier to get a home loan than it is today. Running up to 2006, banks were creating artificial demand by lowering lending standards and making it easy for just about anyone to qualify for a home loan or refinance their current home. Back then, lending institutions took on much greater risk in both the person and the mortgage products offered. That led to mass defaults, foreclosures, and falling prices. Today, things are different, and purchasers face much higher standards from mortgage companies. The graph below uses Mortgage Credit Availability Index (MCAI) data from the Mortgage Bankers Association(MBA) to help tell this story. In that index, the higher the number, the easier it is to get a mortgage. The lower the number, the harder it is. In the latest report, the index fell by 5.4%, indicating standards are tightening. This graph also shows just how different things are today compared to the spike in credit availability leading up to the crash. Tighter lending standards over the past 14 years have helped prevent a scenario that would lead to a wave of foreclosures like the last time. The Foreclosure Volume Is Nothing Like It Was During the Crash Another difference is the number of homeowners that were facing foreclosure after the housing bubble burst. Foreclosure activity has been lower since the crash, largely because buyers today are more qualified and less likely to default on their loans. The graph below uses data from ATTOM Data Solutions to help paint the picture of how different things are this time: Not to mention, homeowners today have options they just didn’t have in the housing crisis when so many people owed more on their mortgages than their homes were worth. Today, many homeowners are equity rich. That equity comes, in large part, from the way home prices have appreciated over time. According to CoreLogic: “The total average equity per borrower has now reached almost $300,000, the highest in the data series.” Rick Sharga, Executive VP of Market Intelligence at ATTOM Data, explains the impact this has: “Very few of the properties entering the foreclosure process have reverted to the lender at the end of the foreclosure. . . . We believe that this may be an indication that borrowers are leveraging their equity and selling their homes rather than risking the loss of their equity in a foreclosure auction.” This goes to show homeowners are in a completely different position this time. For those facing challenges today, many have the option to use their equity to sell their house and avoid the foreclosure process. Bottom Line If you’re concerned we’re making the same mistakes that led to the housing crash, the graphs above should help alleviate your fears. Concrete data and expert insights clearly show why this is nothing like the last time.

Categories

Recent Posts