5 Convincing Reasons to invest in real estate in 2022

In December 2022, will you look back on a year that was a success, or will you wish you’d done more for your retirement? Here are 5 reasons why it is a no-brainer to start investng in real estate this year (or to get another property): 1. Home Price Appreciation is still going up 2021 was a record breaking year in home prices going up, experts are all agreeing that we will continue to see them go up in 2022 and there isn't any reason to see a decline in the near future! 2. Vacancy Rates are low Only 6.2% of livable units iin the country are vacant and there are MANY markets in the country where vacancy rates drop below even 2%! Check out your state here 3. Tax Write Off If you are already own a real estate property, you know that you get to write off your yearly mortgage interest. So you owning a second, third, fourth property, you get to write off all that interest on each property! No only that, now that you own a busines of investing, you get to write off all your 'business expenses'. So don't overlook travel, miles, meals, advertising, and much more! 4. Principle Pay Down You are not paying your mortgage, your tenants are. With our help, we can make sure to help you find a property that when you buy it, you'll be able to rent it out to cover your entire mortgage, and if applicable, the HOA fee. Every single month that your tenant pays your mortgage, that is increasing your home equity! 5. Cash Flow It is fairly simple to get a property that will allow you to 'cash flow'. You'll get extra income that you will make each month from the rent. Whtether this a short-term rental(AirBNB) or long-term rental, you can really capitalize on making a passive income! Bottom Line It is never too late to start investing your families future. Yes, real estate was a lot cheaper 3 years ago, I hate to break it to you though, it ain't getting cheaper. I am here to answer any questions you have. I am here to help you find a property. I am here, so give me a call or text and let's get started... 801.869.0268

2022 Real Estate Forecast

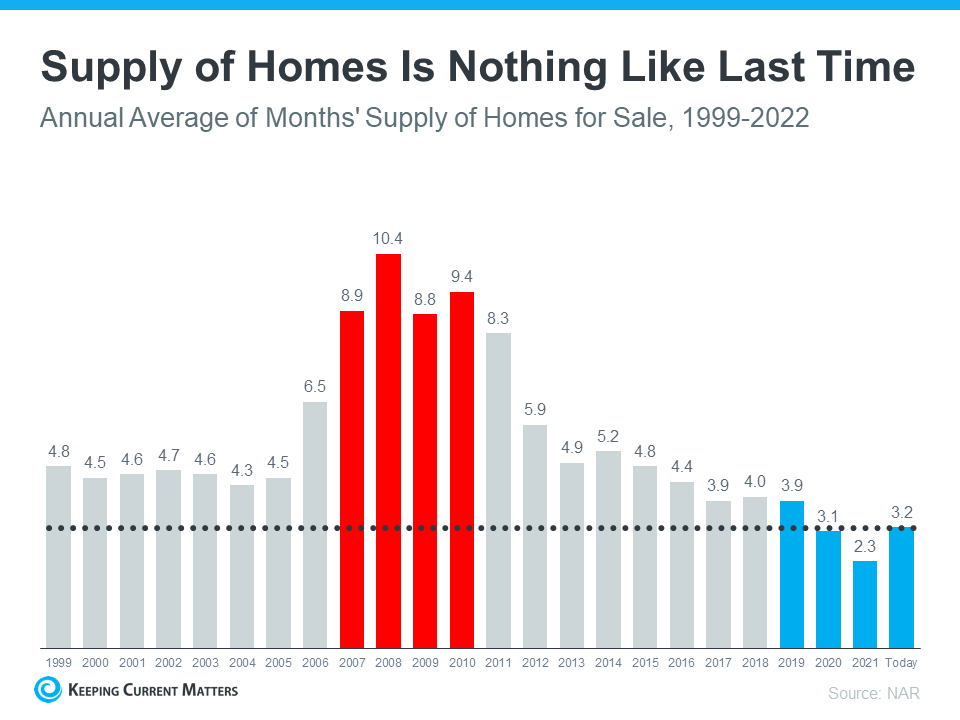

2021 has been nutty! Every expectation from experts were met...they were actually surpassed. 🏠Highest Apprecitation rates 🏠Lowest Interest Rates 🏠Lowest Housing Supply Is it going to continue the same for 2022? Probably...We will continue to witness housing prices going up. Supply will stay stable as we see some buyer demand go up. Interest Rates will tick up, but still stay relatively low.

The Difference a Year Makes for Homeownership

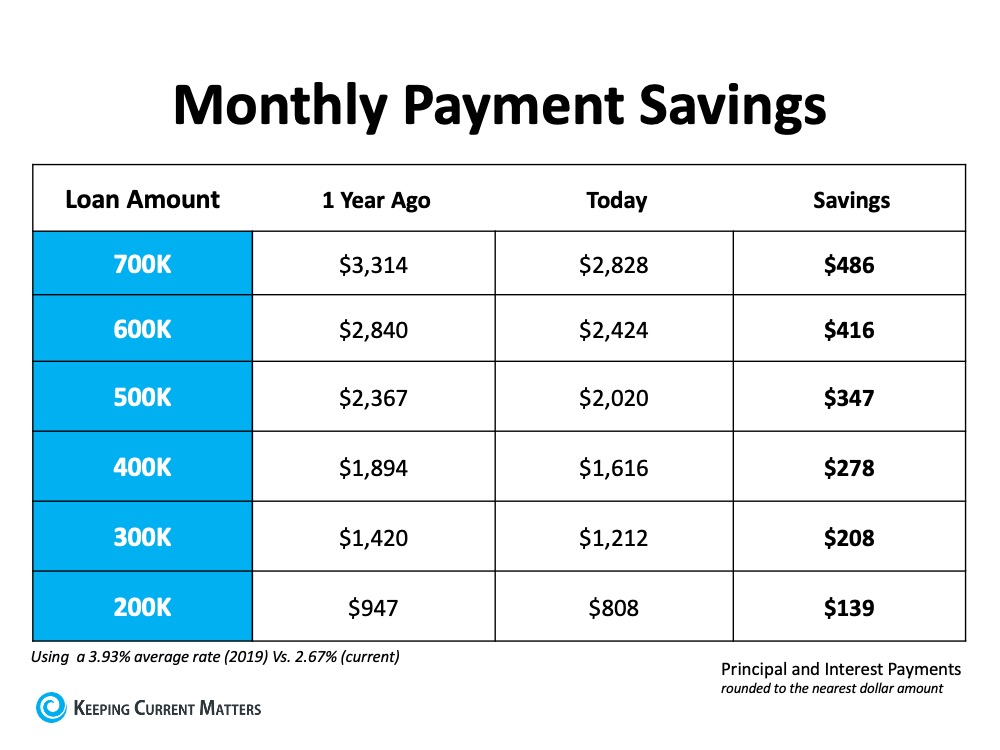

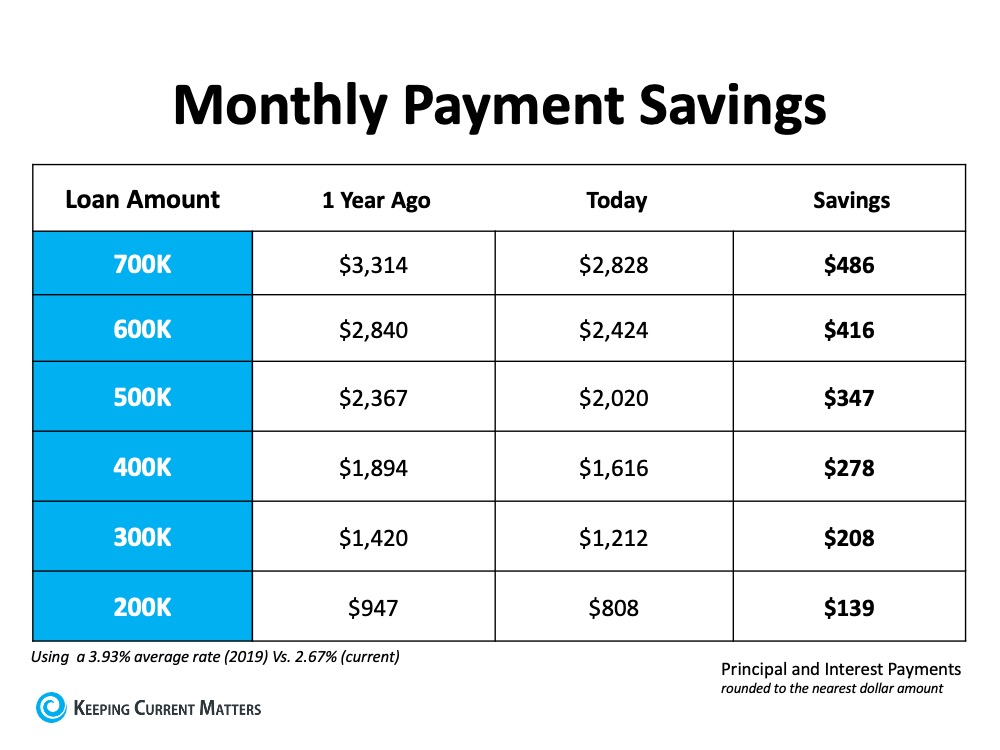

Over the past year, mortgage rates have fallen more than a full percentage point, hitting a new historic low 15 times. This is a great driver for homeownership, as today’s low rates provide consumers with some significant benefits. Here’s a look at three of them. 1. Move-up or Downsize: One option is to consider moving into a new home, putting the equity you’ve likely gained in your current house toward a down payment on a new one that better meets your needs – something that’s truly a perfect fit, especially if your lifestyle has changed this year. 2. Become a First-Time Homebuyer: There are many financial and non-financial benefits to owning a home, and the most important thing is to first decide when the time is right for you. You have to determine that on your own, but know that now is a great time to buy if you’re considering it. Just take a look at the cost of renting vs. buying. 3. Refinance: If you already own a home, you may decide you’re going to refinance. It’s one way to lock in a lower monthly payment and save more over time. However, it also means paying upfront closing costs, too. If you want to take this route, you have to answer the question: Should I refinance my home? Why 2020 Was a Great Year for Homeownership Last year, the average mortgage rate was 3.93% (substantially higher than it is today). If you waited for a better time to make a move, market conditions have improved significantly. Today’s low mortgage rates are a huge perk for buyers, so it’s a great time to get more for your money and consider a new home. The chart below shows how much you would save per month based on today’s rates compared to what you would have paid if you purchased a home exactly one year ago, depending on how much you finance: Bottom Line If you’ve been waiting since last year to make your move into homeownership or to find a house that better meets your needs, today’s low mortgage rates may be just what you need to get the process going. Reach out to us, we are local real estate professionals to discuss how you may benefit from the current rates.

Categories

Recent Posts